Philosophy

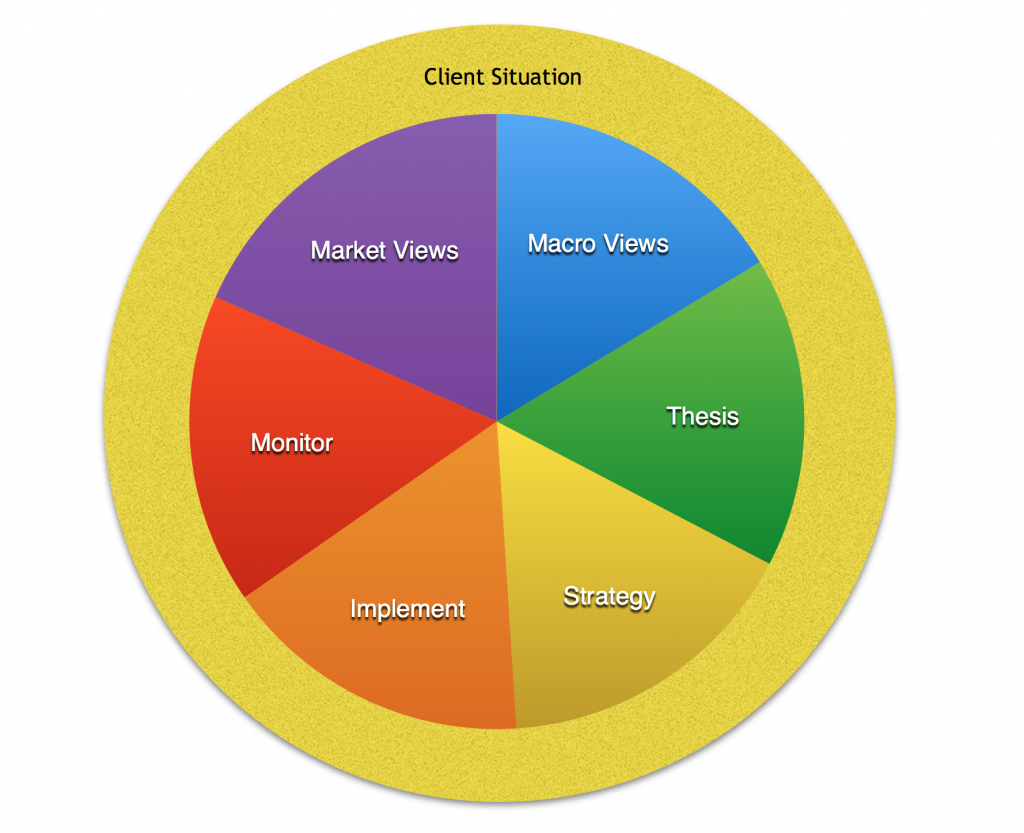

At Softwealth our first consideration when building an investment portfolio is the client specific situation. We take into account the unique situation, goals, needs, risk tolerance, time horizon, liquidity needs, and overall asset holdings.

At Softwealth our first consideration when building an investment portfolio is the client specific situation. We take into account the unique situation, goals, needs, risk tolerance, time horizon, liquidity needs, and overall asset holdings.

Next we account for our market views. We start by looking at current facts, such as, if a market index or asset class is trading at historic lows or highs.

Include a macro economic view – Advances in technology and communication have created a more globally connected world. Macro economic events can significantly impact financial markets. For instance, a sovereign debt crisis in Europe could have an impact on US stocks and bonds. Thus, it is important to account for macro economic views when constructing an investment portfolio.

Apply our thesis – Depending on the investment objectives of the client we then apply a thesis or belief about how the portfolio will react going forward. An example of this would be mean reversion- asset prices tend to revert back to their mean over time. If an asset is trading well above its historic average valuation then it is statistically likely that it will revert lower towards its mean over time.

Utilize strategies – We favor algorithmic strategies over human stock or bond managers. Why? Because historical performance can be more meaningful for algorithmic strategies when doing analysis. For example, a human money manager can deviate from their investment strategy, be impacted by emotion, personal issues, or be terminated. Regardless of performance, algorithms remain consistent and if we know what to expect we can make better decisions.